When you are thinking about travel insurance, you might be wondering, do I really need it? Is it really worth purchasing travel insurance? Well, it is not only about getting sick and requiring medical attention. Flights may be delayed or you may be forced to return home in the event of an emergency. Travel delays can cost you a fortune if you do not have travel insurance. In many cases, you lose the money you have already paid and have to pay for additional bookings.

If your luggage is lost, stolen or damaged, replacing all of its contents, including clothing, personal devices, and medications, can be very expensive. Travel insurance can help you cover some of the cost of these items.

Best TRAVEL INSURANCE Plans for 2023

SafetyWing – Our favorite pick

Best for nomads, (long/short-term) tourists, and remote workers regardless of their nationality.

Travel medical insurance for nomads but also short or long-term travelers.

Pros:

- Great fit for digital nomads, tourists, and remote workers regardless of their nationality. Ideal for long but also short-term trips!

- COVID-19 Coverage: As of August 1st, 2020, this insurance covers COVID-19 disease and works the same as any other illness and does not fall under any other policy exclusion or limitation.

- Price vs Age: Quite affordable considering the pandemic – These prices cover 4 weeks or 28 days with up to a maximum of 364 days after which you will need to repurchase.

- 10 to 39 years old US $40.04 (If you are not traveling in or to the United States)

- 10 to 39 years old US $73.08 (If you are traveling in or to the United States)

- 40 to 49 years old US $64.68 (If you are not traveling in or to the United States)

- 40 to 49 years old US $120.40 (If you are traveling in or to the United States)

- See prices for other age groups here.

- What about outdoor activities – Am I covered?: Safetywings covers more than 94 recreational activities including surfing, biking, hiking, and snowboarding.

- Do I have to pay insurance for my young children? 1 young child (aged 14 days to 10 years old) per adult, up to 2 per family are covered for free.

Cons:

- This insurance does not cover citizens from Iran, Syria, North Korea or Cuba (or have Cuba as your citizenship).

Click here to learn more about this plan.

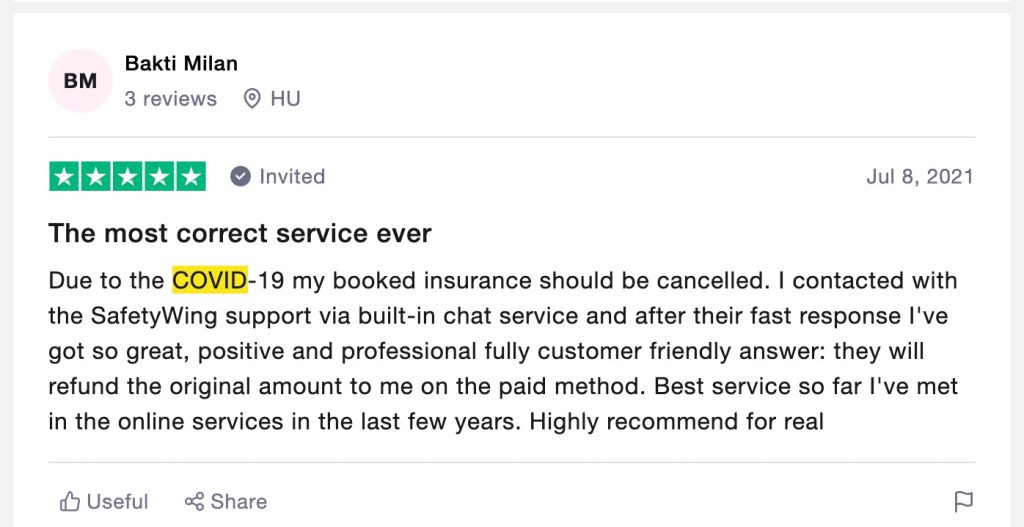

SafetyWing Travel Insurance Reviews on Trustpilot:

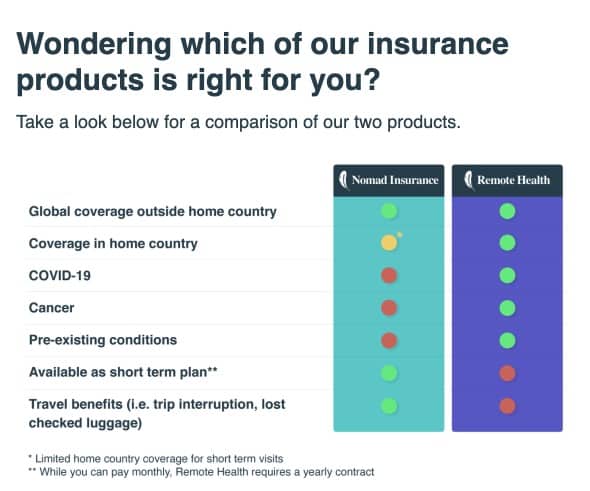

For long-term digital nomads, we also recommend checking their Remote Health insurance which is more pricey but covers pre-existing conditions or covers you also in your home country.

You might also be interested to check 8 digital nomad insurance plans comparison for 2022.

PassportCard Insurance

At PassportCard they constantly adapt and improve based on what the nomad community wants.

In a digital world, people don’t have to be limited by borders anymore. That’s why PassportCard give you access to quality healthcare. Anytime, anywhere since they are committed to provide a superior service experience.

Pros

Complete Flexibility

- You have the option of extending the duration of your plan.

- Cancel it or adjust your insurance coverage.

- Have you made any new plans? Depending on your needs, you can add additional protection.

The red card

- Use the Red Card to pay your medical bills.

- There’s no need to wait for repayment.

- Simply open the app, file a claim, and they will load money onto your card so you can pay any bills straight away.

Their App

- The app provides insurance services 24 hours a day, seven days a week.

- Find a doctor near you, load money onto your card, view your plan’s coverage benefits, change your information, and more.

- 24-hour emergency service

Other features

- Your policy can be acquired while you are already abroad.

- Monthly subscription – cancel or extend at any time

- Pay with the red card rather than your own money.

- International coverage starts at $59/month.

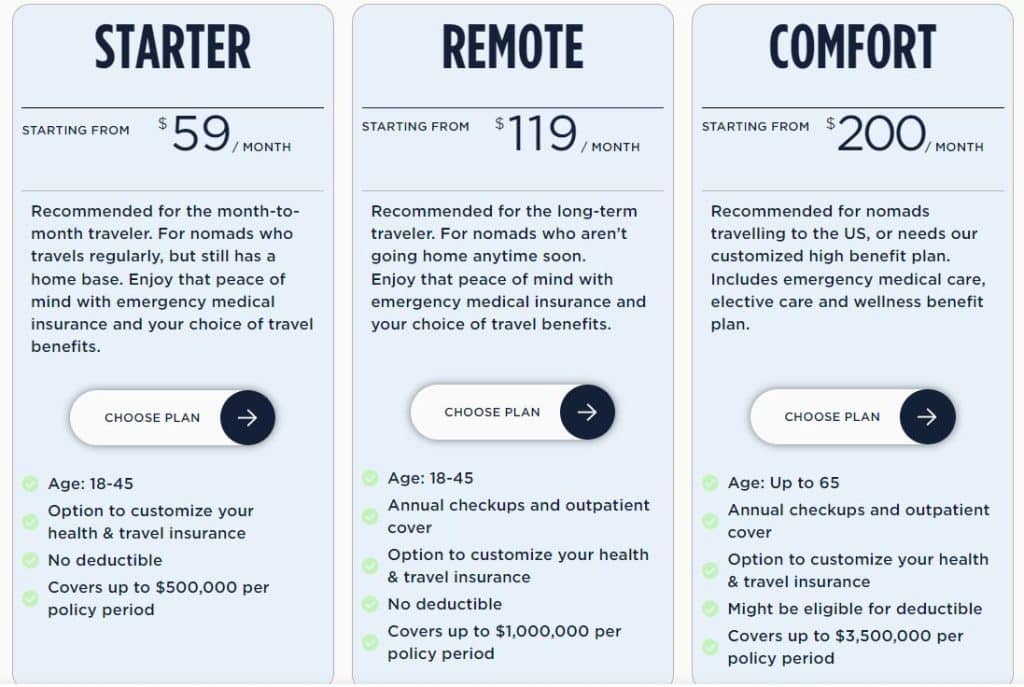

Plans

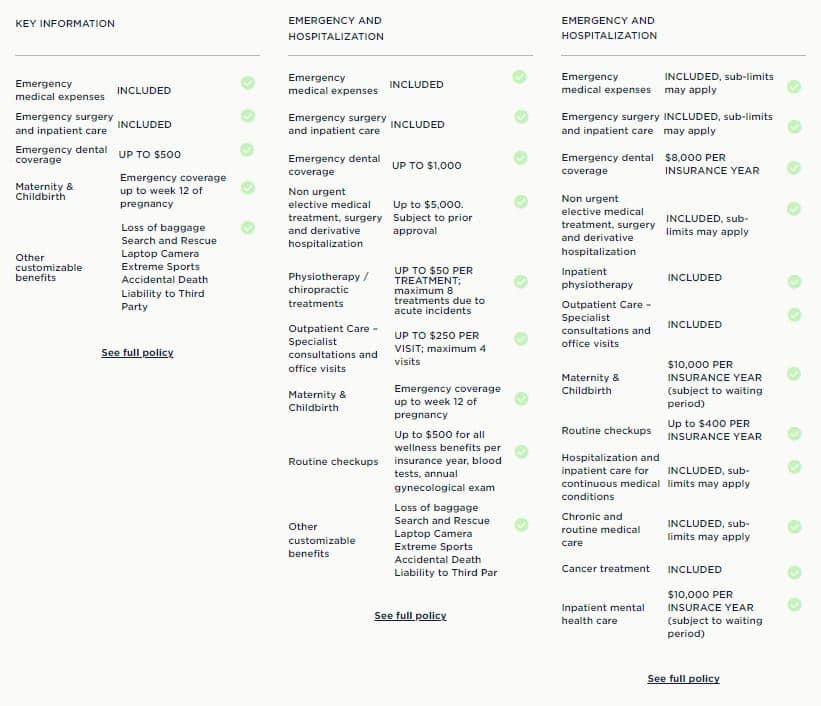

STARTER (starts at $59 / Month)

Traveling for less than six months? Enjoy emergency medical coverage as well as a variety of travel insurance advantages such as laptop and camera search and rescue, baggage loss, and extreme sports.

Up to $500,000 per policy period. Min. insurance period of 1 month.

REMOTE (Starts at 119 / Month)

Traveling for more than 6 months? Stay protected whether traveling or working outside of your native country.

Take emergency medical coverage, non-urgent elective medical treatment expert consultations, office visits, and wellness care with the Starter offer’s optional travel features.

Up to $1,000,000 per policy period. Min. insurance period of 1 month.

COMFORT (Starts at $200)

Traveling for more than 12 months?

If you are a professional globetrotter who spends years traveling, you nesaed comprehensive international health insurance.

This includes emergency medical care, non-urgent elective medical treatment, specialist consultations and office visits, hospitalization for persistent conditions, chronic and routine medical care, and an excellent wellness benefits package.

Up to $3,500,000 per policy period.

Get your quote here!

World Nomads

First and foremost, World Nomads travel insurance has been endorsed by National Geographic, Eurail, International Volunteer HQ, and Lonely Planet. This may give you the first sneak peek of the quality of the service you are buying.

World Nomads insurance covers nomads, remote workers and adventure seekers from 150 countries. You can purchase short or long-term according to your travel needs.

Let’s talk about the basics in the middle of a pandemic; this insurance offers medical evacuation and 24-hour emergency assistance. This may be related to adventure activities you are engaging in, or in case you get sick with COVID in a country that may not have the medical facilities you are used to.

Pros:

- If you want to engage in extreme sports or very adventure activities, their Explorer program will cover you at every step.

- Extending your coverage service is at your fingertips. Once your coverage is over you can go online and easily extend it.

- Claims are handled very quickly.

- Its Explorer Policy is unique in the market.

Cons:

- It can be a bit expensive. But if you are a kind of adventure traveler, this is the right fit for you.

- World Nomads cover people in more than 150 countries; this also means that costs and coverages can vary depending on the area you are traveling to.

- It’s quite possible you need to have health insurance in your country of origin in order to get their add-on services.

- Scooter related accidents are mostly not covered.

Summary

World Nomads insurance gives you probably the best coverage if you like to engage in adventure activities at a fair price. The World Nomads standard plan, pretty much covers what others do. But in case you want an upgrade, this would be a great choice.

Heymondo Travel Insurance

Best for travelers going on single trips who don’t want to commit to a long-term contract.

Most travel insurance companies offer protection for 30 days to 6 months. Heymondo not only offers protection for long stay plans, but also for single trips when you are traveling for work or tourism and know your departure and return dates.

Pros:

- Great fit for – Single or multiple-single-trip travelers

- Heymondo covers medical assistance from USD $100.000 up to USD $10.000.000 (conditions apply)

- Coverage limit – USD $ 250,000 or USD $ 500,000 depending on your plan

- Time of purchase: You can get it before or during your trip

- You don’t need to commit to a long-term contract

Other benefits:

Heymondo Travel Insurance Reviews from Trustpilot

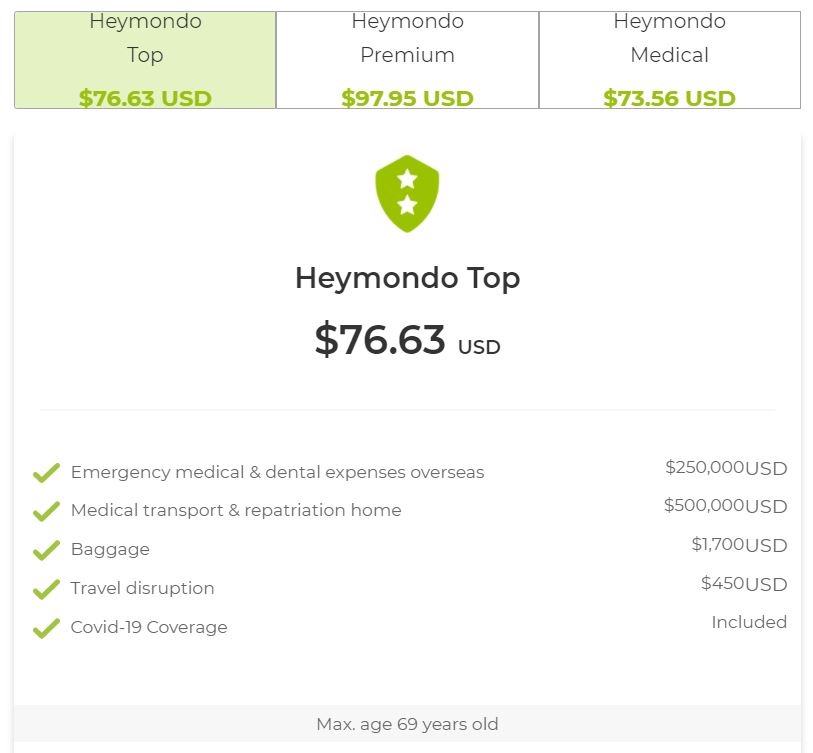

Both Heymondo Top and Heymondo Premium cover:

- Medical and dental emergencies overseas

- Medical transport and repatriation

- Baggage

- Travel disruption

Cons:

- It may be a little bit expensive. For a 2-week trip from the U.S. to Europe Heymondo Premium costs USD $ 97.95, Heymondo Top costs USD $ 76.63 and Heymondo medical costs USD $ 73,56.

- Heymondo medical doesn’t cover baggage loss or travel disruption.

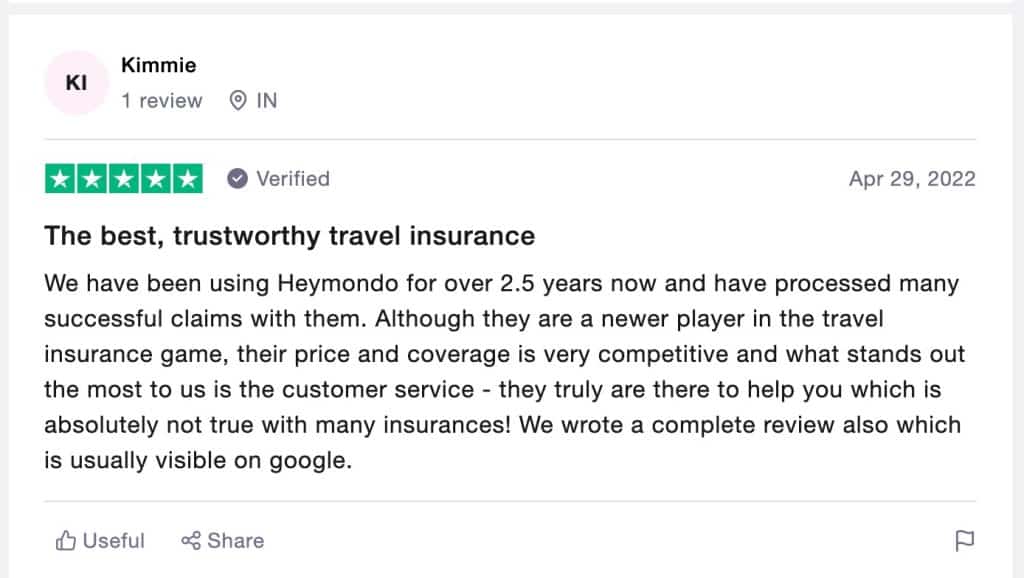

CoverAmerica-Gold, Travel Insurance for US by VisitorCoverage

Best for nomads, tourists, and remote workers visiting the US

CoverAmerica-Gold is a good choice for travelers visiting the U.S. who are NOT citizens or residents of that country. VisitorsCoverage offers plenty of insurance plans for needs of any kind of travel.

Pros

- Great fit for nomads, tourists, and remote workers visiting the United States

- Coverage limit? It may cover up to US1,000,000 (conditions apply).

Other benefits

- Covers acute onset of pre-existing conditions

- Loss of passport or travel documents

- Foreign excursions and cruise coverage around North America

- Emergency dental treatment & eye exam

- Missed connection benefit available during international travel to the U.S.

- Prices by age

Source: Cover America Gold Brochure

Cons:

- It’s NOT available for Americans, US Green Card Holders or long term visa holders, who stay in the USA permanently, and pay taxes in the USA.

- It does NOT cover citizens from Iran, Syria, US Virgin Islands, Ghana, Nigeria, and Sierra Leone.

Click here to learn more about this plan.

Travel Insurance for Canada by VisitorCoverage

Very similar package to the one mentioned above for traveling to the United States.

This plan is ideal for US citizens traveling to Canada but also visitors from other countries around the world.

Check more info about this plan here.

TRAVELEX INSURANCE SERVICES – FOR ALL TYPES OF TRIPS

Travelex insurance has built its travel portfolio considering not only regular travelers but also digital nomads and the new remote workers.

It has demonstrated excellent coverage on single trips, short luxury getaway weekends as well as long stays in foreign countries.

One of the features we like the most about Travelex Insurance Services is that this company allows people to customize their coverage according to the particulars of their travel needs. Another good characteristic is that even the basic plan gets you ALL the essentials. We find it a great fit for avid travelers because it brings flight-specific protection.

We have gathered some pros and cons so you can make an informed decision!

Pros:

- 24/7 Assistance with a travel concierge! – How many times have you missed great spots or haven’t accessed to benefits just because you did not know they existed? Well, Travelex travel assistance will serve you as travel concierge even in legal matters. Nobody knows when you can mess up with unknown rules in a foreign country.

- Similar to the previous one. In case of a medical emergency, Travelex will cover your emergency treatment and evacuation. It also includes a companion.

- In case you, or your companion passes away, this policy also covers the cost of transporting remains home.

- 98% of insurance claims are paid.

- In case you have to cancel or interrupt your trip for any of the covered reasons, you will get a reimbursement of the money you have already spent on your trip.

Cons:

Beware that some basic services may have an additional cost.

It’s not the cheapest one. A 22-year-old remote worker can pay from $ 324 and $491 for a 90-day trip.

Liaison Travel Plus*

Best for tourists, and remote workers visiting the U.S

Travel insurance for visitors to the U.S. and U.S. citizens traveling abroad.

Pros

- Great fit for nomads, tourists, and remote workers around the world.

Coverage features

- Coverage limit? Up to 5,000,000

- Coverage Area – you can choose between two options:

- Worldwide coverage including the USA

- Worldwide coverage excluding the USA

- Any pre-existing conditions? – It covers them through the benefit for acute onset of pre-existing conditions.

- Price – It depends on several factors. You can buy from 5 to 364 days. Click here for prices.

Other traveler benefits

- Loss of checked baggage – US $50 per article, US $500 per occurrence

- Trip interruption US $5,000

- Travel delay US $100 per day, 2-day limit per occurrence

- Lost or stolen travel documents US $100

- Border entry protection (for non-United State residents traveling to the United States) US $500

- Personal liability US $50,000

Cons

- Travelers must be at least 14 days old and under 75 years to be covered by this plan

- It does not cover citizens from Iran, Nigeria, Cuba, Iran, Syria, Virgin Islands, Gambia, Ghana, Sierra Leone, and North Korea.

- It does not cover trips to Antarctica, Iran, Syria, Cuba, and North Korea.

Click here to learn more about this plan.

*(Administered by Seven Corners, Lloyd’s of London and Tramont Insurance Company)

AXA – Global Healthcare / Travel Insurance

Best for British citizens traveling and working overseas, ex-pats, and other EU citizens

This company provides medical care, routine checkups and lengthy hospital stays for travelers around the world.

Pros

- Great fit for British citizens traveling and working overseas, ex-pats and other U.E. citizens.

Other benefits

- This insurance company allows choosing between long-term and short-term stays.

- Price – Depends on the countries you are visiting or living in.

Cons:

- You will not be covered for Coronavirus if you travel to a country against the advice of the Foreign and Commonwealth Office (FCO) for a leisure trip.

Click here for more info about insurance plans with this company

Few More Travel Insurance Companies:

- AXA Schengen Insurance

- USI Affinity Travel Insurance Services – Ruby Policy

- TravelSafe Insurance

- Safe Travels Voyager – Great for Seniors

- Coverwise, Travel Insurance

- Allianz Global Assistance

- TravelTime Travel Insurance

- IMG Global, The BEST TRAVEL INSURANCE For Seniors

- Roamright

- CAT 70 – Forbes 5-Star Insurance Provider

TRAVEL INSURANCE FAQs:

Travel insurance should start on the day when your journey to your destination begins.

The price of travel insurance depends mostly on the type of coverage, age and length of the trip. It can start as low as $10 per day.

We consider SafetyWing as one of the best travel insurance companies but there are plenty of other reliable insurance travel companies that we recommend in our post.

We hope you’ve liked this comparison of health travel insurance plans! We hope you’ve found a suitable plan for your next adventure during these rough times!

Let us know in the comment below if you have any suggestions, ideas or feedback about travel insurance. We appreciate any kind of feedback.