When you become a digital nomad or long-term traveler, you know that unexpected things can happen and you always need to be insured.

Considering the option of traveling without insurance is NO GO! Even a simple doctor’s visit or medical check-up in a foreign country as a tourist can be very expensive.

Without insurance, you can end up in a big debt if something serious happens to you. Also, having your gear stolen may be an annoying problem for your wallet and also your business or remote job if you “travel and work from anywhere“.

Best Digital Nomad Insurance for Health & Travel:

1. SafetyWing – Digital Nomad Insurance – Monthly Plans start from $56.28

SafetyWing is a remote working company that is rapidly gaining new clients. Their specialty is providing primary health insurance for nomads.

1. Essential Plan

Perfect for travelers who need reliable short-term coverage abroad.

- Covers trips up to 364 days at a time

- Includes emergency medical treatment, hospital stays, surgeries, and medications

- Protection for lost luggage, travel delays, and emergency evacuations

- Offers up to 30 days of medical coverage in your home country

- Starting at $56.28 every 4 weeks for ages 18–39

Ideal for: Short-term travelers and remote workers looking for affordable medical protection while abroad.

2. Complete Plan

Comprehensive, long-term health insurance designed for full-time travelers and remote professionals.

- Includes everything in the Essential Plan, plus ongoing, renewable coverage

- Covers routine and emergency medical care worldwide

- Adds wellness therapies, mental health support, and cancer treatment

- Protects against burglary, canceled accommodations, and delayed luggage

- No coverage restrictions in your home country

- Starting at $161.50 per month for ages 18–39

Ideal for: Digital nomads and expats seeking complete, indefinite health and travel protection anywhere in the world.

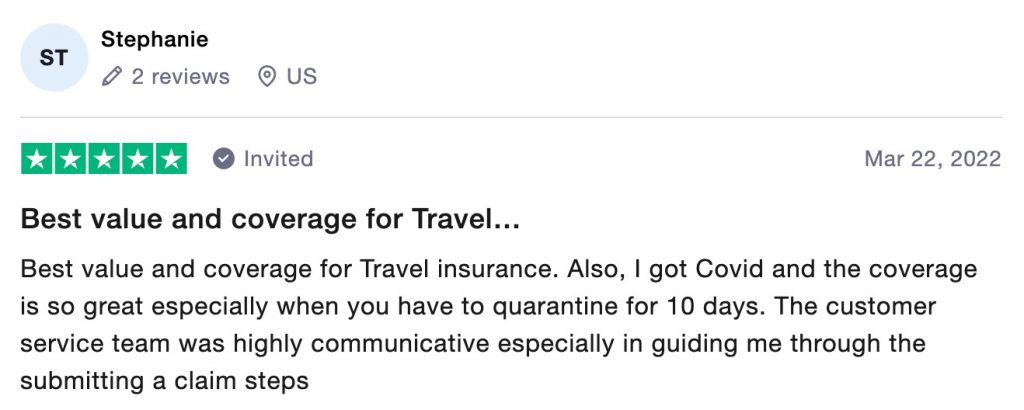

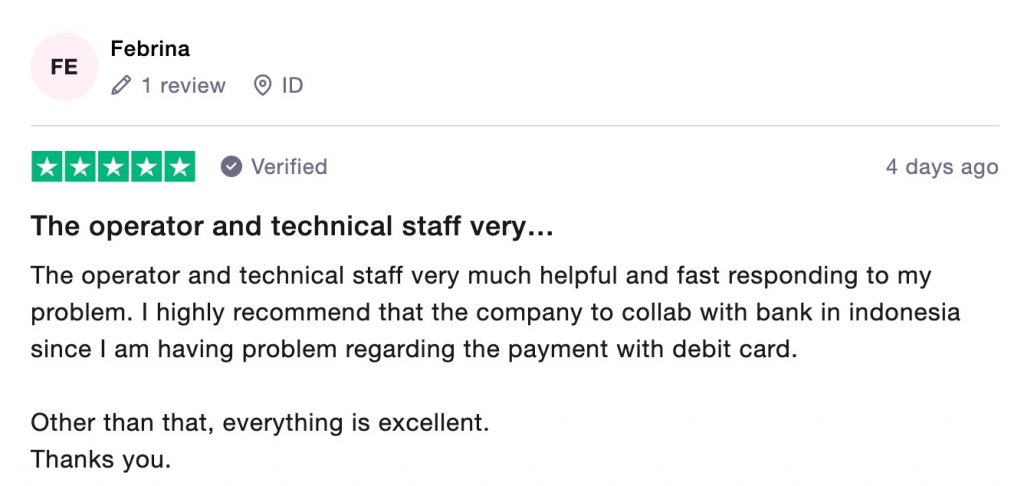

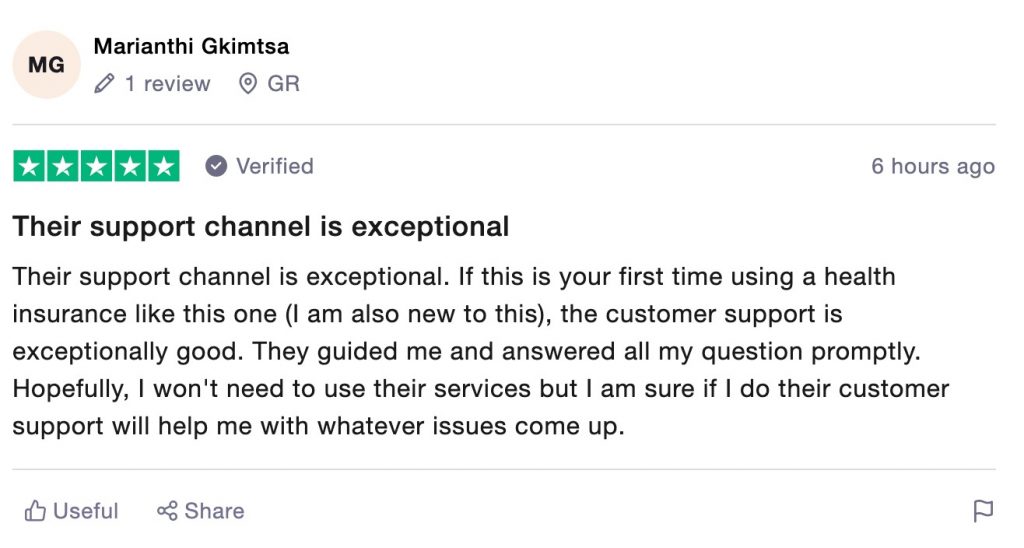

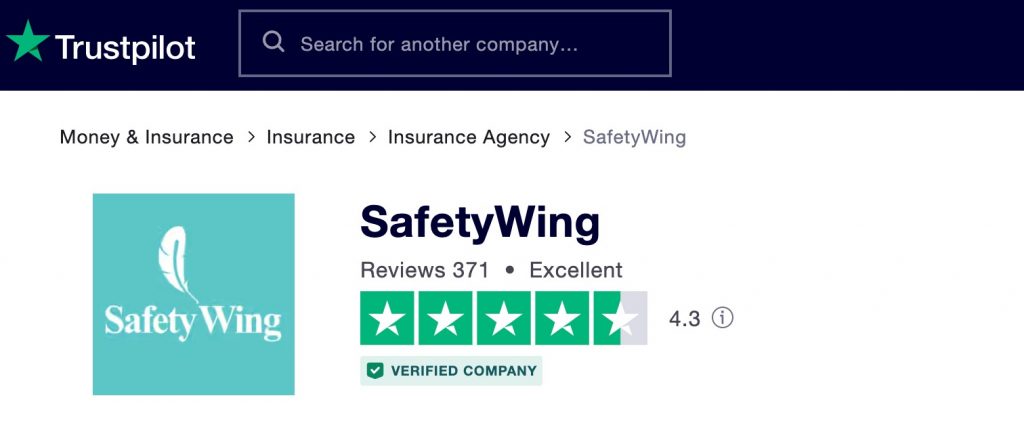

Recent customer reviews of Safetywing on trustpilot.com

2. PassportCard Nomads – Nomad Insurance

PassportCard Nomads offers flexible insurance plans tailored to the needs of digital nomads, freelancers, and frequent travelers. Whether you’re on a short trip or living abroad full-time, these plans are designed to provide peace of mind with instant coverage and zero paperwork.

1. Starter Plan

Perfect for short-term travelers or those just beginning their nomad journey.

- Covers emergency medical treatment, hospital stays, surgeries, and prescriptions

- Includes medical evacuation and repatriation in case of serious emergencies

- Access to 24/7 multilingual support and an instant payment card for covered expenses

- Option to extend coverage or upgrade to a higher plan anytime

- Ideal for trips up to 6 months

Best for: Travelers who want essential, affordable medical coverage without long-term commitments.

2. Remote Plan

Designed for long-term digital nomads who live and work abroad full-time.

- Includes everything in the Starter Plan, plus coverage for non-urgent and specialist care

- Access to routine checkups, diagnostics, and follow-up treatments

- Global coverage across countries — no need to reset or repurchase when moving locations

- Mental health support and wellness therapies are included in select regions

- Flexible renewal and cancellation options directly through the PassportCard app

Best for: Remote workers and full-time nomads seeking reliable, renewable health protection worldwide.

3. Comfort Plan

A premium, expat-style insurance plan for travelers who want complete medical and lifestyle coverage.

- Everything in the Remote Plan, plus comprehensive health benefits for long-term living abroad

- Covers chronic conditions, maternity, wellness programs, and preventive care

- Includes alternative medicine options such as acupuncture, osteopathy, and chiropractic care

- Coverage for burglary, lost or delayed luggage, and canceled accommodations

- No restrictions in your home country — continuous global protection wherever you are

Best for: Experienced nomads and expats who want all-inclusive coverage and premium benefits year-round.

3. Insured Nomads

Insured Nomads is a modern insurance solution built for digital nomads, expats, and frequent travelers who live life without borders. With a focus on safety, convenience, and global mobility, it offers comprehensive protection that goes far beyond traditional travel insurance.

World Explorer Plan

Ideal for short-term travelers, backpackers, and adventure seekers.

- Coverage for single or multiple trips, up to 364 days

- Includes emergency medical, evacuation, and trip protection

- Adventure activities covered under most tiers

- Starting at around $45 per 4 weeks for ages 18–39 (price varies by destination and coverage level)

Best for: Travelers who need affordable, flexible coverage for trips under one year.

Remote Health Plan

Designed for digital nomads, remote professionals, and expats who live abroad full-time.

- Comprehensive global health insurance, renewable indefinitely

- Includes routine care, hospitalization, maternity, mental health, and wellness coverage

- Telemedicine access and worldwide doctor network

- Starting at around $155 per month for ages 18–39 (depending on coverage tier and region)

Best for: Long-term travelers and remote workers who want full, year-round health coverage anywhere in the world.

4. Heymondo Travel Insurance

Heymondo Travel Insurance is a comprehensive travel insurance provider designed to offer travelers peace of mind during their trips. They provide coverage for medical emergencies, trip cancellations, luggage loss, and other travel-related incidents, ensuring you are protected no matter where you go.

Most common plans include:

Basic Plan: Covers essential medical expenses, trip cancellation, and baggage protection. Pricing starts from approximately €20-€30 for short trips (up to 7 days) for travelers under 30 years old, with prices increasing based on age and coverage duration.

Standard Plan: Adds additional protections like better medical coverage limits, emergency assistance, and optional coverage for sports activities. Prices start around €40-€60 for similar trip lengths and age groups.

Premium Plan: Offers extensive coverage, including high medical limits, trip interruption, 24/7 emergency assistance, and optional coverage for high-risk activities. Pricing typically begins at €70-€100 depending on trip details and traveler age.

Disclaimer: Affiliate links are links that allow website owners to earn a commission on any sales generated by a click from their website. It’s important to note that some of the links on this website may be affiliate links, which means that if you click on the link and make a purchase, I may receive a commission.