Initially, there were the flashy Influencers, flaunting opulent yacht parties to their followers, who were enduring pandemic-related lockdowns. Following that, there was an influx of Russian wealth, comprising cash and cryptocurrencies, seeking a sanctuary away from burdensome sanctions in the aftermath of the Ukraine invasion.

The recent influx of wealthy digital nomads in Dubai appears to be made up of affluent Western hedge fund professionals, as evidenced by the notable exodus of talent from firms such as Millennium Management and ExodusPoint Capital Management. The emirate and its neighboring city of Abu Dhabi are actively luring the rich and influential with enticing offers such as tax-free status, relaxed regulations, and a time zone that favors exchanges with Asia.

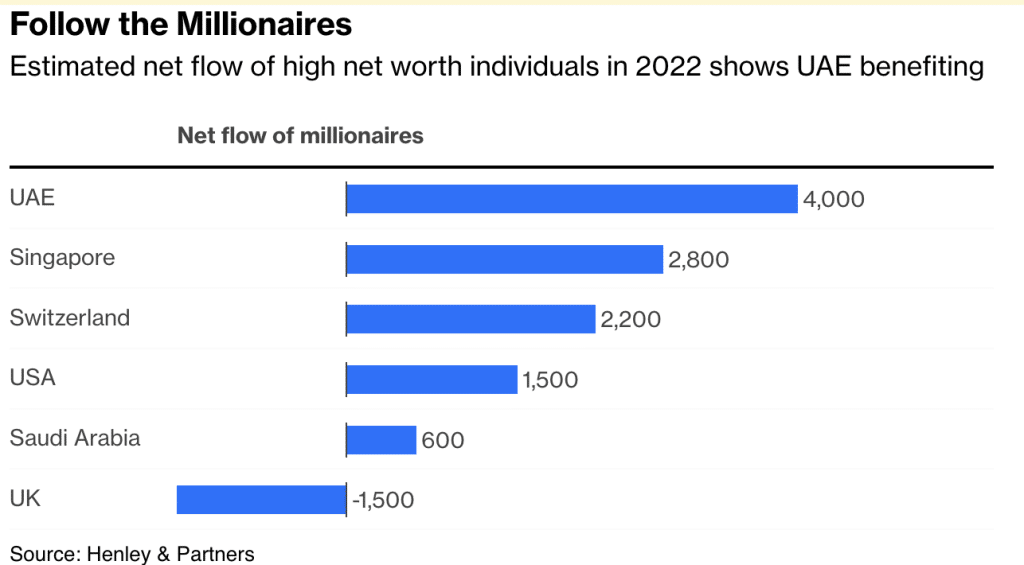

For some, this situation may evoke a sense of “déjà vu” that seems incongruous with the hedge fund industry’s lackluster growth, poor performance, and challenging fundraising environment over the past year. Nonetheless, in a world dominated by geopolitics and conflict, the Gulf region is likely to prove a crucial test case in the competition for high-net-worth talent. This development is bound to attract the attention of tax authorities in Western countries, especially at a time when budgets are already strained.

The landscape has changed considerably since Dubai’s earlier ambitious effort to establish itself as a global financial center. Back then, the city’s aspirations led to a speculative real estate bubble fueled by debt and built on shaky ground. During a visit to Dubai in the midst of the financial crisis in 2009, Lionel Laurent witnessed numerous foreign investors lose significant sums through real estate speculation. When the bubble inevitably burst, Abu Dhabi, the neighboring city with a more conservative approach, stepped in to save and control the situation.

The United Arab Emirates has the famous Louver in Abu Dhabi, the world’s tallest building in Dubai, and has become a financial center that is attracting the attention of hedge funds looking for alternatives to traditional centers like Zug or Geneva, where banking secrecy and Credit Suisse accounts are no longer available. According to reports, some 50 hedge funds, which collectively manage more than $1 trillion in assets, are actively seeking a license in Dubai. The emirate strategically touts its attractiveness with a “zero personal income tax regime,” which is a marked difference from the top tax rates of 45% to 55% common in European countries. In addition, Dubai positions itself as a “neutral ally” for both the West and the East in times of conflict.

Dubai’s rising popularity can be attributed to its thriving tourism industry, lack of income tax, and status as a destination free of Russia sanctions.

However, there is no single solution that explains this success. The UAE is not simply an old-fashioned tax haven. In an effort to diversify its revenue sources away from oil revenues, the country has taken steps to level the playing field, including the introduction of a corporate income tax for the first time. In addition, the UAE has responded to pressure from Western sanctions by taking decisive action to close local Russian banks. The country, described by Jared Cohen of Goldman Sachs Group Inc. as a “geopolitical swing state,” benefits from its strategic geopolitical importance.

The rise in energy prices has given the country an abundance of capital and a willingness to use it for strategic purposes, including financing ventures. In addition, the ongoing war in Ukraine has given the country significant leverage. Germany has been forced to ask Abu Dhabi for help in securing gas supplies during the winter season. At the same time, Washington DC is eager to use its association to increase its influence, possibly leading to a disregard for money laundering risks, as reported by Politico.